One more NFO – New Fund Offer is on the way.Axis MF Children’s Gift Fund.As name indicates, Child will be the beneficiary investor.

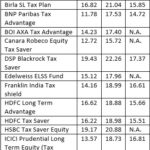

There are already few funds based on this theme like those offered by mutual fund houses like HDFC, ICICI Pru,TATA ,SBI etc.

Few details of Axis Children’s Gift Fund are as follows:

- Imp Dates:This is open ended fund which is available for initial subscription from Nov 18, 2015 to Dec 02, 2015.Fund will reopen for subscription within few days.

- Eligibility :Child will be beneficial investor so having a minor child will be basic eligibility .Parents / donars are gifting mutual fund units to child.

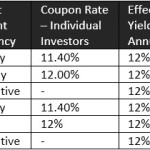

- Type of Fund & Taxation:Fund will be Equity oriented-Balanced fund.Net Equity component will be limited to max 60% and remaining equity exposure 5-15% will be maintained through arbitrage i.e simultaneous buy -sell at cash – future market.As per current taxation laws, this fund will be treated as Equity fund and long term capital gain tax will be Nil.

- No 80C Benefit : This is not ELSS scheme, neither offered by insurance company.So it won’t have 80C tax benefit on lumpsum / installments paid.

- Lock in Period :Units can be kept in Lock in till child attains age of 18 yrs.Opting for Lock in period is not compulsory.

- Exit load structure : If lock in is not opted then exit load applicable if units are redeemed.Exit load will be 3% for exit with in one yr, 2% for exit within one to Two yr , 1% for exit within two-three yrs from purchase of units.

- Either parents,Grand parents or relative can invest in name of child.

- KYC compliance :KYC compliance of natural guardian is essential. If grandfather or relative is investing on behalf of child then they need to be KYC compliant along with parent or Legal guardian.

- Third party declaration :will be applicable.

- Different facilities like – Systematic investment , Systematic withdrawal,dividend transfer – are applicable but subject to lock in period if opted.

- If dividend plan is opted or at time of redemption : child’s bank AC details need to be provided as child is beneficiary.After attaining majority child will be owner of mutual fund units.

This is one more balanced fund.Just it gives clear aim of investing for your child’s future expenses like – Education and marriage.

One can not deny that inflation in education system is much more higher than general CPI – consumer price inflation….so one need to invest for child since today.

But this can be achieved by investing any other good performing equity or balanced fund also.

Also View :Portfolio of 5 Mutual Fund schemes

Balanced funds like this one can have lower NAV volatility compared to pure equity fund.Performance of other funds of Axis Mutual fund is Good (w.r.t benchmark) and same can be expected from this fund…so invest through this fund or any other fund………… just need is to understand the volatility & basic functioning of equity market.