Birla Sun Life Mutual Fund – Recurring Saving Plan[RSP]

Equity markets are currently not supporting for mutual funds and now it seems that mutual funds are trying to focus on their debt funds where equity risk is low or negligible.

Birla Sun life – Recurring Saving Plan is one of the similar attempt to promote the debt fund.

Birla Sunlife MF have tried to create an alternative for Bank recurring deposits.

Key Features in Brief:

- Monthly SIP plan in selected debt funds.

- Free Life insurance Cover.

Important Features of Recurring Savings Plan:

Systematic Saving is allowed through following plans:

- Birla Sunlife Medium Term Plan.

- Birla Sunlife Monthly Income Plan [MIP].

This fund aims to identify mispriced credit opportunities in medium term securities and optimise returns by selectively investing in them.

SIP Performance Of Birla SunLife Medium Term Plan Since Inception:

| Birla Medium Term plan | Benchmark Index | Originally Invested | |

|---|---|---|---|

| Mar2009 | 5000 | 5000 | 5000 |

| Apr2009 | 10018 | 10055 | 10000 |

| May2009 | 15074 | 15167 | 15000 |

| June2009 | 20165 | 20155 | 20000 |

| July2009 | 25285 | 25309 | 25000 |

| Aug2009 | 29749 | 30286 | 30000 |

| Sept2009 | 34773 | 35290 | 35000 |

| Oct2009 | 39745 | 40462 | 40000 |

| Nov200 | 44937 | 45820 | 45000 |

| Dec2009 | 50163 | 50930 | 50000 |

| Jan2010 | 55391 | 56146 | 55000 |

| Feb2010 | 60633 | 61330 | 60000 |

| Mar2010 | 65857 | 66530 | 65000 |

| Apr2010 | 71254 | 71869 | 70000 |

| May2010 | 76605 | 77329 | 75000 |

| June2010 | 81901 | 82535 | 80000 |

| July2010 | 87309 | 87876 | 85000 |

| Aug2010 | 92514 | 92936 | 90000 |

| Sept2010 | 98137 | 98416 | 95000 |

| Oct2010 | 103640 | 103821 | 100000 |

| Nov2010 | 109067 | 109203 | 105000 |

| Dec2010 | 114769 | 114323 | 110000 |

| Jan2011 | 120581 | 120058 | 115000 |

| Feb2011 | 126175 | 125268 | 120000 |

| Mar2011 | 132033 | 131134 | 125000 |

| Apr2011 | 138394 | 137321 | 130000 |

| May2011 | 144218 | 142584 | 135000 |

| June2011 | 150206 | 148531 | 140000 |

| July2011 | 156833 | 154868.04 | 145000 |

| Aug2011 | 162193 | 161248 | 150000 |

| Sept2011 | 168277 | 167289 | 155000 |

| Oct2011 | 175509 | 172975 | 160000 |

| Nov2011 | 181784 | 179186 | 165000 |

| Dec2011 | 188380 | 185662 | 170000 |

| Jan2012 | 194766 | 191864 | 175000 |

| Feb2012 | 201121 | 198414 | 180000 |

| Mar2012 | 205664 | 204463 | 185000 |

| Apr2012 | 214374 | 210978 | 190000 |

| May2012 | 223109 | 217601 | 195000 |

| June2012 | 229694 | 224256 | 200000 |

| July2012 | 236156 | 230921 | 205000 |

| Aug2012 |

Monthly Invested Rs.5000/- Since inception:

Value as on Aug 01,2012: 2,36,156.

If same invested in Benchmark : Rs.2,30,921/-.

Birla Sunlife Medium Term Plan SIP Returns Since Inceptions : 8.10 % compounded per annum.

B] Birla Sunlife MF Monthly Income Plan:

Monthly Income Plans are debt funds with small dash of equity power,upto 20% of the portfolio.

| Birla MIP | Benchmark Index | Originally Invested | |

|---|---|---|---|

| July2007 | 5000 | 5000 | 5000 |

| Aug2007 | 10089 | 10021 | 10000 |

| Sept2007 | 15198 | 15122 | 15000 |

| Oct2007 | 20635 | 20680 | 20000 |

| Nov2007 | 25651 | 25917 | 25000 |

| Dec2007 | 31189 | 31336 | 30000 |

| Jan2008 | 36797 | 36855 | 35000 |

| Feb2008 | 40241 | 40845 | 40000 |

| Mar2008 | 44528 | 45710 | 45000 |

| Apr2008 | 49260 | 50604 | 50000 |

| May2008 | 54951 | 56450 | 55000 |

| June2008 | 58652 | 60246 | 60000 |

| July2008 | 61876 | 63661 | 65000 |

| Aug2008 | 67692 | 70207 | 70000 |

| Sept2008 | 72804 | 75070 | 75000 |

| Oct2008 | 75199 | 77006 | 80000 |

| Nov2008 | 80283 | 82238 | 85000 |

| Dec2008 | 88297 | 89125 | 90000 |

| Jan2009 | 96865 | 95414 | 95000 |

| Feb2009 | 102108 | 101210 | 100000 |

| Mar2009 | 106096 | 104185 | 105000 |

| Apr2009 | 117689 | 115322 | 110000 |

| May2009 | 125128 | 122720 | 115000 |

| June2009 | 133092 | 132141 | 120000 |

| July2009 | 137442 | 134807 | 125000 |

| Aug2009 | 144300 | 141440 | 130000 |

| Sept2009 | 150770 | 147972 | 135000 |

| Oct2009 | 157881 | 154778 | 140000 |

| Nov200 | 164282 | 160315 | 145000 |

| Dec2009 | 170747 | 167241 | 150000 |

| Jan2010 | 177409 | 173283 | 155000 |

| Feb2010 | 180889 | 176185 | 160000 |

| Mar2010 | 187955 | 183472 | 165000 |

| Apr2010 | 195182 | 190839 | 170000 |

| May2010 | 200641 | 196484 | 175000 |

| June2010 | 205840 | 201508 | 180000 |

| July2010 | 213583 | 209045 | 185000 |

| Aug2010 | 220156 | 214340 | 190000 |

| Sept2010 | 228074 | 221923 | 195000 |

| Oct2010 | 234377 | 229924 | 200000 |

| Nov2010 | 241856 | 236480 | 205000 |

| Dec2010 | 244655 | 238939 | 210000 |

| Jan2011 | 249966 | 244589 | 215000 |

| Feb2011 | 252577 | 246314 | 220000 |

| Mar2011 | 260521 | 255095 | 225000 |

| Apr2011 | 269670 | 263485 | 230000 |

| May2011 | 273723 | 267126 | 235000 |

| June2011 | 279926 | 272690 | 240000 |

| July2011 | 288176 | 280733 | 245000 |

| Aug2011 | 291760 | 284290 | 250000 |

| Sept2011 | 297360 | 288850 | 255000 |

| Oct2011 | 303138 | 294166 | 260000 |

| Nov2011 | 311607 | 301267 | 265000 |

| Dec2011 | 316001 | 307606 | 270000 |

| Jan2012 | 322334 | 315977 | 275000 |

| Feb2012 | 335342 | 328006 | 280000 |

| Mar2012 | 340926 | 333911 | 285000 |

| Apr2012 | 346996 | 339441 | 290000 |

| May2012 | 350914 | 344111 | 295000 |

| June2012 | 359289 | 352386 | 300000 |

| July2012 | 369786 | 362245 | 305000 |

| Aug2012 |

Value of Rs.5000/- invested in Birla Sunlife MIP as on 01/08/2012 : 369449.

Annual compounded SIP Returns for Last 5 Yrs : 8.30%

BenchMark Value For Same investment : Rs.362245.

Above graphs indicates that both funds have beat benchmarks for last 5 Yrs.

Age Limits:

- Min Age at Entry : 18 Yrs.

- Maximum Age at Entry : 46 Yrs.

Free Life Cover with Birla RSP:

Insurance is free and through Group insurance cover… Insurance cover is 10 times the monthly RSP amount in first year of SIP,50 times for second year & 100 times from third year onwards,subject to maximum limit of Rs.20 lakh.

Exit Load:

Exit Load is 2% for exit within completion of first tear,1% for exit between 1-3 yrs and nil thereafter.Investors investing through this plan should have a horizon of 5-6 yrs to accumulate some good amount and so exit load don’t matter much.

Partial Withdrawal:

Possible subject to exit load as stated above and Insurance cover will be ceased if its stopped within first three years.

Comparison of Recurring Saving Plan with Recurring Deposits From Banks:

- Rate of interest is known earlier for Bank or postal RDs.While in Recurring Saving Plan rates are not known but can consider in line with recurring deposits.

- Free Life cover as stated above is available for consistant investors of Birla recurring saving plan.

- Debt funds are more tax efficient than Bank recurring deposits.Taxation issues of debt funds have discussed time to time.

- In general , banks charge penalty for missed installment like Rs.2 to 3 per Rs.1000/-.

- In both the case,if two consecutive installments are missed then plan will auto closed.

- In both the cases,time horizon should be at least 5-6 yrs to accumulate good amount of capital.

Bottomline:

Its not possible to generalise anything about this plan.But conservative investors or individuals with high tax brackets can think to invest in Monthly Income Plan [MIP] through RSP.In general above 40 yrs of age,term insurance do not remain as cheap so such investors who are not willing to buy fresh term insurance at this age can also think to save money through this plan and fulfill their need of insurance cover at least partially.

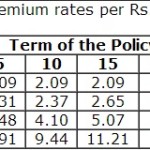

Birla sunlife recurring Saving Plan annual primam chate

Wow, marvelous blog layout! How long have you ever been running a blog for? you made running a blog glance easy. The overall look of your site is excellent, let alone the content material!