Muthoot Finance of the largest Gold loan company has come up with an issue of Secured and Un-secured NCDs in April 2017.Details of Muthoot Finance April 2017 NCD issue are as follows.

Imp dates:

- Issue open date:April 11, 2017.

- Issue close date:May 10, 2017.

Credit Ratings: CRISIL AA / ICRA AA.Both indicates stable issue.

Coupon Rates:

NCD issue offers coupon rates ranging from 8 t0 9% depending on tenure & interest payment frequency.

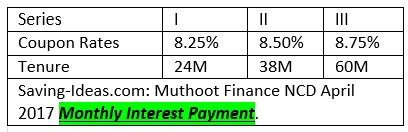

Monthly Interest payment:

Interest payable monthly from date of allotment.

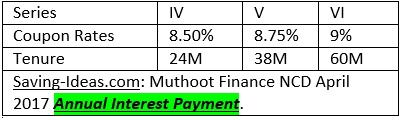

Annual Interest Payment:

Interest payment annually from date of allotment.

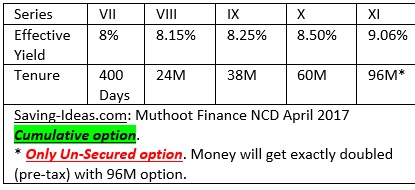

Cumulative Option:

Compounded annual Interest and principle will paid at maturity.

Other details:

- Minimum investment amount Rs.10,000 onwards.

- NRIs are not eligible to apply.

- Allotment first cum first served basis, per day basis.

- Demat mode compulsory:Demat account is compulsory if you wish to invest in this issue.

- Security: Company will provide 100% security cover for secured NCDs and interest thereon.While unsecured NCDs will be subordinated debt & no security cover will be provided.

Company intends to raise Rs.1950 crore against secured NCDs and Rs.50 Crore against unsecured NCD issue.