Now,investors can manage their savings more efficiently after introduction of Instant Access Facility (IAF) by Liquid schemes of certain mutual funds.Investor can have instant access to money up to Rs.50,000 or up to 90% redeemable fund value,which one is lower.

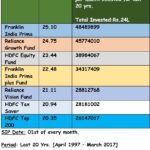

Currently following funds are offering instant access facility:

Facility will be available only in Growth option.

- Reliance Liquid Fund-Treasury Plan.

- DSP Blackrock Liquidity fund.

- UTI Money Market fund.

- Birla SL Cash Plus

- SBI Instacash Fund.

- ICICI Prudential Liquid Fund.

- Indiabulls Liquid Fund

What investors need to remember while opting for instant redemption facility:

- To opt for this facility,IFSC code need to be registered in the folio.

- Investors registered bank need to be Immediate Payment Service (IMPS) enabled.

- Facility may available for transactions made only through website or mobile app.

- As per SEBI guidelines, funds offering Instant Access Facility (IAF)can keep daily redemption limit as Rs.50,000 or 90% of redeemable fund value which one is lower.

- Routine offline redemption facility as per current business cycle available as it is.

What investor should understood:

Investors should understand that there might be certain scenarios when Instant Access Facility can be suspended or may not be available and such redemption can be processes like normal redemption..

Probability of suspension of this facility may be rear but it can be done under following scenarios:

- Requests for redemption are much more higher than routine number.

- If there are clearing issues from bank side.

- If scheme is facing extreme liquidity issues.

- Operational / Technical issues in online redemption facility.

Rest, this is very good facility being offered by mutual funds where investor can invest idle cash in liquid funds, stand a chance to get reasonable appreciation and at the same time it can take care of unseen emergency expenses.

Please read UTI Money Market Fund instead of UTI Savings Fund.