If you have checked AUMs (Asset Under Management) of balanced funds,they are sky rocketing now a days.Along with positive market conditions, another important reason is they are paying monthly income in terms of dividends to investors.Thanks to optimistic market conditions,investors are also preferring them over traditional products like bank deposits,Postal MIS,Senior Citizen Saving Scheme,immediate annuity etc.

Today we will take view of balanced funds paying dividends periodically.

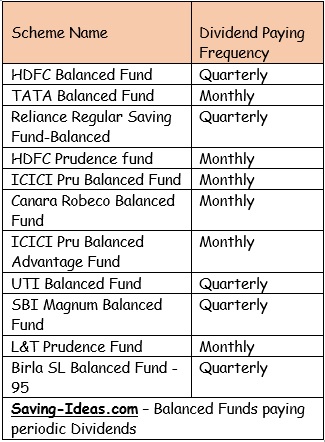

Following are few balanced funds paying periodic dividends like monthly or quarterly:

so is it good idea to invest in balanced funds paying regular dividends:

I think, investor can …if it is in need of regular income,is in high tax bracket and have proper asset allocation in place .Dividends paid from mutual fund schemes are tax free in hands of investors.

But till there are certain factors which investors should remember.

What investor should remember while investing in such options:

1. As per SEBI rules and regulations, any mutual fund scheme can pay dividend through profit generated / accumulated by that scheme only.so its possible that scheme may not pay dividends in long term bear phase.

2.Paying periodic dividends is not legally binding on mutual fund scheme.

3.Investors capital need not to be protected as investors profitability will depend on when he / she has entered in to the scheme & even though scheme is in profit..it doesn’t mean that every investor is in profit.

4.Dividends can kill compounding and harm returns in long term.so opt for periodic dividends if absolutely needed.

5.Periodic means need not to be fixed dividend amount.Dividend amount can vary depending on schemes profitability.

So conclusion is – Basic objective of balanced funds is to optimize risk, with allocation between equity & debt & provide commensurate returns.They are relatively lower volatile than pure equity funds.But are not completely risk proof. Till, it may not be harmful to opt periodic dividends if investor is investing through proper asset allocation and understands that NAV drops proportionately after each dividend is paid & principal may or may not get protected.