SREI Infra – only Infrastructure Finance Company (IFC) status company among NBFCs have come up with public issue of Secured,NCDs which will open on Sept 07, 2017.SREI is looking to raise Rs.250 crore with an option to retain over subscription up to Rs.1000 crore.

Imp Dates:

- Issue Open Date:Sept 07, 2016

- Issue Close Date:Sept 28,2016.

Security : NCDs are secured.Company will create appropriate security to ensure 100% cover for NCDs and interest thereon.Axis Debenture Trustees are trustees of this issue.

Credit Rating: BWR AA+ by Brickwork which indicates higher safety of the issue.For last NCD issue it was AA.

Investment options:Investor have different investment options for period of 400 Days, 36 Months & 60 Months with Cumulative,Monthly Interest Payout & Annual interest payout options.

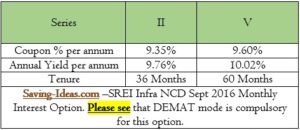

Monthly interest payment option:

Monthly interest payment option is available for 03 Yrs and 05 Yrs period.Also, Demat mode is compulsory if you opt for monthly interest payout.

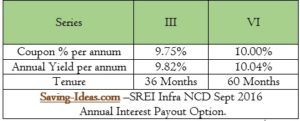

Annual Interest payment Option:

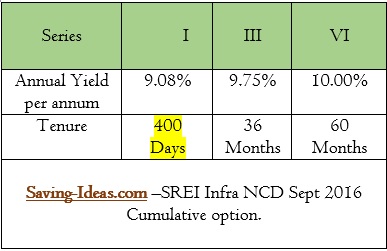

Cumulative Interest payment:

Series: I,III and IV.

Other details:

- NCDs will listed at BSE & NSE.

- Min application amount: Rs.10000/-.

- Non-ASBA applicants will get 8% application money interest.

- NCDs are fully secured.

- Allotment is on first come first served , per day basis.

- 60% of issue size is reserved for individual investors.

- Share Holding pattern: Indian promoters are holding around 60% and Banks,institutional ,FIIs have holding around 18.67% in this company.

Should you invest or not:

Considering lower side bank deposit rates we have witnessed a heavy demand across these NCDs. So we may also see good demand for this issue.Suggestion is do not invest for listing gains only.Judge your credit risk and invest a part of fixed income in this issue.