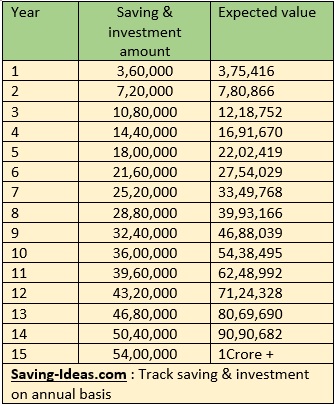

Ramesh has recently started for saving & investing.For now,he has kept target of Rs. 1 cr within next 15 years.

We will prepare a flow of valuation on annual basis with some assumptions so that he can track his progress of investment and benchmark his saving & investment against this value on annual basis.

Here we have made assumptions:

- Monthly saving & investment: Rs.30,000/-

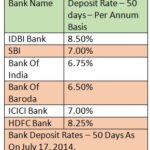

- Net interest rate assumed: 8%.

- Compounding Frequency : Annually.

If you are expecting higher or lower rate then for required monthly investment you can refer:

What Should You Invest Per Month To Get The Target Of Rs.1 Crore:

Then target corpus of Rs.1 Crore will be reached in following way.

- To track the progress of investment,compare valuation with this table.E.g if you have completed 4 yrs and have same goal then if your valuation is around 17 L or more then consider that you are on right track.

- If you are lagging in valuation then try to save more next year & try to fill up gap as early as possible.

- In case of equity,growth won’t be linear in this way.If lagging, try to cover the gap with some top up investment.

- Even though you have irregular cash flow & its not possible for you to invest systematically, use expected value to compare with current valuation.

- Consider liquid assets only which can be easily sell out in market like Fixed deposits,mutual funds,shares etc.

- If you have different goal in your mind then convert values proportionately.