Generally, investor has two options to invest lump sum in mutual funds.First is to invest directly in equity mutual fund and other is to invest lump sum in liquid fund & then transfer fixed amount systematically in equity fund.

2008 market crash is well known & wild swings can affect the overall performance of funds.We will check fund performance under high volatility period from January 2008 till April 2016.

Today, we will take past reference if investor have invested Rs.5 L lump sum at market peak in 2008 & if STP was initiated at the same time.

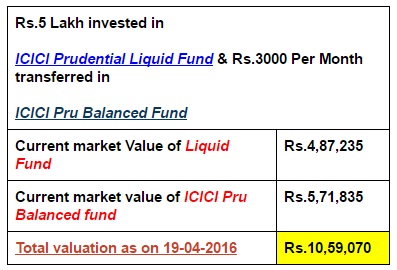

Here we will assume that investor have invested Rs.5 lakh in ICICI Prudential balanced fund on January 01, 2008 & if on the same date STP was initiated from Liquid fund To balanced fund.

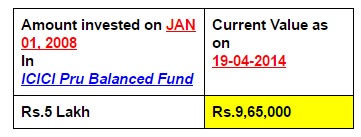

Lump sum investment:

Result of lump sum invested :

Result of Systematic investment:

Summarizing,

- Valuation as on today (18-04-2016) if Rs.5 lakh invested lump sum: Rs.9,65,000.

- Today’s valuation if Rs.5 lakh invested systematically: Rs.10,59,070

Concluding,

- Valuation is higher for systematic investment as market have gone through high volatility.

- Systematic investor may have psychological support if market went through high volatility.

- Its not possible for any one to predict extent of volatility so lump sum Vs systematic debate is irrelevant. Lump sum investment may work better in absence of downside volatility and vice versa for SIP.

- Choose lump sum or Systematic option based on cash flow requirements & risk profile.