Different PSUs -NTPC,PFC,REC,IRFC,NHAI,IREDA,HUDCO have issue tax free bonds and raised around Rs.40,000 crores through tax free bonds issued to public & through private placements.

Here we have summarized tax free bonds issued in financial year 2015-2016 along with allotment and interest payment dates.

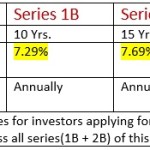

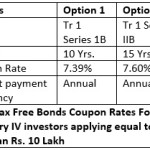

| Issue Name | Allotment Date | Interest Payment Date |

| 7.62% NTPC TAX FREE BONDS SEPT 2015 | OCT 05, 2015 | OCT 05. |

| 7.60% PFC TAX FREE BONDS OCT 2015 | OCT 17, 2017 | OCT 17. |

| 7.43% REC TAX FREE BONDS OCT 2015 | NOV 05, 2015 | DEC 01 |

| 7.53% IRFC TAX FREE BONDS DEC 2015 | DEC 21, 2015 | OCT 15. |

| 7.60% NHAI TAX FREE BONDS DEC 2015 | JAN 11, 2016 | APRIL 01 |

| 7.74% IREDA TAX FREE BONDS JAN 2016 | JAN 21, 2016 | JAN 21 |

| 7.64% HUDCO TAX FREE BONDS JAN 2016 | FEB 08, 2016 | FEB 08 |

| 7.69% NHAI TAX FREE BONDS FEB 2016 | MARCH 09, 2016 | OCT 01. |

| 7.64% NABARD TAX FREE BONDS MARCH 2016 | March 23, 2016 | 23rd March. |

| 7.69% HUDCO TAX FREE BONDS MARCH 2016 | March 15, 2016 | DEC 15. |

| 7.64% IRFC TAX FREE BONDS MARCH 2016 | March 22, 2016. | Oct 15. |

Annual interest received is tax free.

All bonds were oversubscribed due to high demand from retail as well institutional investors.Investors are suggested to hold bonds for long term as there won’t be tax free bonds in 2016-2017.

![Power Finance Corporation Limited [PFC]- Tax Free Bond Issue Dec 2012 -Details & Interest Rates](http://www.saving-ideas.com/wp-content/plugins/related-posts/static/thumbs/12.jpg)