NPCI -National Payment Corporation Of India have recently issued circular and asked mutual funds to migrate from ECS – Electronics Clearing System to NACH registration for servicing of SIPs – Systematic investment plans.SIP is a way of periodic investment where installments are debited from investors bank account.

NACH – National Automated Clearing House is faster,centralized and improved clearing service.

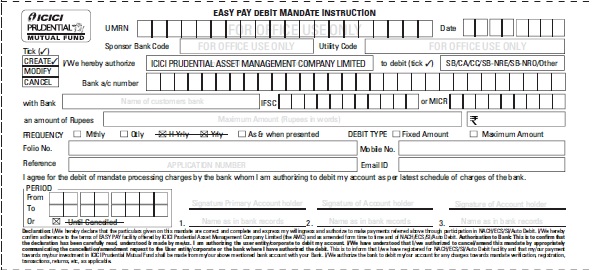

Sample form of ICICI Prudential mutual fund:

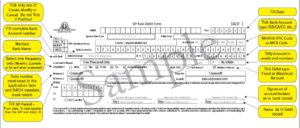

Sample pre-filled NACH form of Franklin Templeton:

Click on image to enlarge.

Precautions to take while filling NACH form:

- Do not alter,over-write any thing otherwise NACH mandate will likely to be rejected.

- Do not use whitener to erase the options.

- If any option is pre-ticked then do not tick any option provided.

How it will impact new SIPs:

Investors need to use new NACH forms for systematic registration instead of ECS forms. ECS forms may not be accepted by banks.

What will happen to existing SIPs:

There won’t be any impact on ongoing SIPs registered..till their validity.But use new NACH form while renewal.

NACH Registration benefits:

- As NACH is faster process , overall registration time can be reduced up to 10 days instead of earlier 30 days.

- If there is rejection of mandate from bank side then investors can easily come to know reasons of rejection …like signature mismatch etc.

Will banks charge investors for NACH Registration / Cancellation:

Clarity will emerge whether banks will charge investors for NACH registration / cancellation or not.

Though SIP registration time can be reduced to 10 days it is suggested to keep a gap of 30 days between mandate submission & first SIP date …till further clarity is emerged.