IFCI Ltd has come up with -Public Issue of Secured Non-Convertible Debentures – of face value of Rs.1000 each , up to Rs. 250 Crore with an option to retain over subscription up to shelf limit Rs. 2000 crore.

Govt Of India is major share holder in IFCI with Govt stake around 55%.

Imp Dates:

- Issue Open Date: Oct 20, 2014.

- Issue Close Date:Nov 21, 2014.

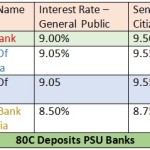

Interest Rates:

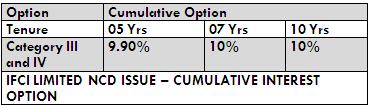

This issue offers different investment options Viz. Monthly interest option, Annual interest and cumulative.

Coupon rates indicated below are for HNIs (applying for more than 2 Lakh )and Retail individual Investors / HUFs (Applying for less than Rs. 2 Lakh)

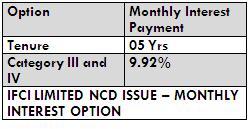

Monthly Interest Option:

One can check that for for monthly interest option available for 05 yrs tenure only at rate 9.92% per annum.

Please Note: Demat Account is compulsory for monthly interest option.

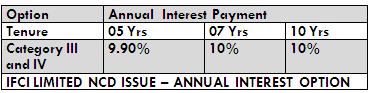

Annual Interest Option:

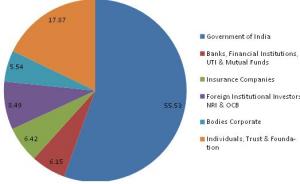

Share Holding Pattern :

Current share holding pattern of IFCI is as follows:

One can check Govt Of India being major share holder with 55.53% stake.As well LIC holds 3.73% and govt Pension funds holds 1.53% shares at IFCI.

Credit Rating:

ICRA “A” and BrickWork AA-: both indicates medium safety of issue.

What are concerns of IFCI:

Higher Non Performing Assets & provisioning- Gross NPA is around 15% while Net NPA is around 10%.But at the same time company have shown good rise in net interest income in recent quarter.

IFCI being promoted by GOI ,10% interest rate for next 5-10 yrs can be a good bet considering reducing interest rate scenario ahead.

Yes ifci ncd 2014 good investment. I am giving 1.20 % commission on total investment. Mb no 9462659179.