One of the reader of this blog have cash of around Rs.25 Lakh in his bank account .He will need this money after couple of months and till he wish to invest some where to get some optimum returns -more than 4% offered by general saving account.

Since he need money after couple of months we will consider period of 50 days only as we need to keep some allowance period.

No Equity or long term Debt funds:

First suggestion will of course don’t think for any equity or long term debt – income funds.As period of 50 days is too small and one should not think for volatile asset for such a short period.

Bank Short Term Deposits:

My first preference will be for short term deposit of tenure 50 days with my bank where my saving account is.Short term deposits are currently attracting deposit rate of 6-8% per annum basis and I should not expect much more beyond this.

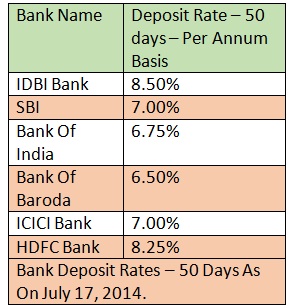

Fixed Deposit rates – 50Days:

Deposit rates of few leading PSU and private banks are as follow

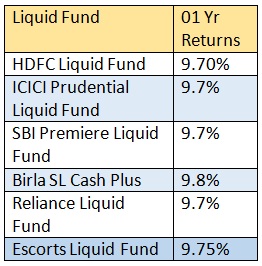

Liquid Funds:

Liquid funds can be another option.As per current scenario… liquid funds can offer returns of 8.50-9.5% per annum basis.But one need to complete KYC formalities(if not current investor) and may need to gather some information or may need to take guidance from some one.

Saving Account with higher interest rate:

Few banks are offering interest rates up to 7% on saving account.List includes banks like Kotak Mahindra or YES Bank…but it may not be feasible to open the account if there are not major cash flows in this account.

so from my point of view..few above mentioned options are available for short term investment purpose..suggestions are wel-come if any..

I want to know some best stocks to invest for 3 years and mutual fund for SIP

Hello,

Its not possible for me to recommend any stocks.

For mutual funds, you can start with balanced fund like TATA balanced fund.

If you are looking for aggression then invest in ICICI Pru.Value discovery,SBI bluechip, Mirae asset India opportunities and HDFC mid cap opportunities.

Regards.

hi admin,

what about the tax on maturity ? pls reply.

Hi,

Income will be added in your total income.Interest from saving account up to Rs.10,000 is free from income tax.

Thank you.

I would suggest equity arbitrage funds that combine the benefits of a)Market agnostic funds b)Tax free dividends c)Risk similar to debt funds d)Exit load nil after 3 months for funds like IDFC arbitrage fund

http://freefincal.com/can-you-think-of-a-risk-free-and-tax-free-financial-instrument/

Thank you for the link.

Yes..Arbitrage or spread funds can be good option..One can see NAV charts mostly linear without much deviation.This is virtually risk free option suitable for high tax zone individuals as tax treatment is alike Equity funds.. with annual returns 8-9%.

Also fund suggested IDFC arbitrage fund is good fund and have a good track record.

Thank you.