I was among few investors who were stuck in Dividend Reinvestment option of ELSS – Equity Mutual Fund Scheme.ELSS is Tax Saving Scheme eligible for 80C benefit and investment subject to lock in period of 03 years from purchase date.

How I stuck in ELSS Dividend Reinvestment Option:

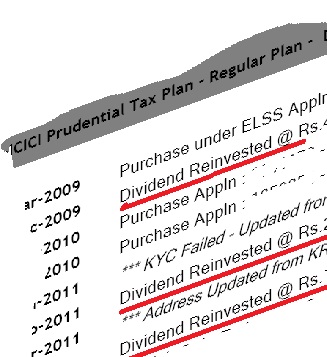

In 2009 when invested in ICICI Prudential Tax plan – by mistake I forget to mark sub-option : Payout and my investment went in by default dividend sub option : Reinvestment.

Why ELSS Divided Reinvestment was a flawed Option:

Under dividend reinvestment option,dividend declared is reinvested and gets locked in from reinvestment date.Since dividend declared is generally with annual frequency..few units would be always under lock in.

As dividend Reinvested is not eligible for 80C ..unlike interest o NSC..this option was full of errors.

As mentioned in above image,initial investment made in 2009 ..expected to be completed in 2012 but units received via dividend reinvestment in 2011,2012 etc would s.t 03 yrs lock in.

Dividend Reinvest to Dividend Payout:

For existing investors, ELSS dividend reinvestment options have been converted in to Dividend payout option and investors shall no more stuck under this option.but investor need to wait for completion of lock in period for units already received through dividends.

For new investors there won’t be any dividend reinvestment option in ELSS scheme.

If investor do not want dividend received in bank account – then they can opt for DTP -Dividend Transfer Plan – where dividend will be reinvested in any other open ended fund of the same AMC.