Shriram City Union Finance – RBI registered Deposit taking Non-Banking finance company – NBFC will raise Rs.200 crore through public issue which will open on April 16, 2014.This issue will offer highest rate of interest@11.75% for period of 60 months.

Details of Shriram City NCD issue April-2014 are as follows:

About shriram City Union finance:

- Shriram city started its operation in 1986.

- Floated its Equity IPO in 1994.company listed at NSE and BSE.

- Different basket of products like – Two wheeler loan and vehicle loans,Gold Loan,Personal loan,Auto Loans ,Home loans ,MSME segment loans etc.

- Market share of around 40% in small loan segment.

- Focused on serving the non-corporate component (proprietary units and partnership firms) of the Micro,Small and Medium Enterprises (MSME) through small ticket loans.

- More than 1000 business outlets across India.

- Good Capital Adequacy ratio of 23% against minimum RBI requirement of 15%.

Imp Issue Dates:

- Issue Open Date:April 16, 2014

- Issue Close Date:May 16,2014.

Interest Rates – HNIs & Retail Individual Investors:

| Series | Tenure –Months | Interest Rate per annum | Interest payment frequency |

| I | 24 | 11.00 | Annual |

| II | 36 | 11.50 | Annual |

| III | 60 | 11.75 | Annual |

| IV | 24 | 11.00 | Cumulative |

| V | 36 | 11.50 | Cumulative |

| VI | 60 | 11.75 | Cumulative |

This issue offers above six different options both Annual interest and cumulative mode…for tenures of 24,36 and 60 months.

Security : NCD issue is secured – company have offered 100% security cover on outstanding amount any time during tenure of NCD in the form of immovable assets and future receivables of company.

Credit Rating : AA from CARE.

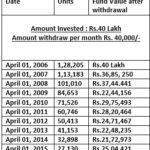

Shriram City annual sale Report for Last 05 Years- In Crores:

Shriram City – Annual Profits From Operations – In Crores:

Shriram City – Profit After Tax – for Last 05 Yrs in Crores:

Profit for last 03 quarters in current financial year:

| Quarter ended | Profit after tax-PAT – in Crores |

| June 2013 | 117.42 |

| Sept-2013 | 127.20 |

| Dec-2013 | 129.09 |

One can observe that company have reported growth in terms of annual sale,Operational profits or net profits after paying taxes.

One can not deny that finance companies are always exposed to credit risks i.e. bad loans.Though credit risk is the integral part of operations of such companies,Overall a good issue with better credit rating,increasing profits- to invest a small portion of overall fixed income portfolio.