Are you a regular mutual fund investor and are you looking for some more diversification apart from funds which have common stocks like ICICI,HDFC,Reliance and others…there are few funds which are selective in stock picking and IDBI Tax Saving – ELSS scheme is one such fund which have good portfolio of stocks which have good fundamentals and long term potential.

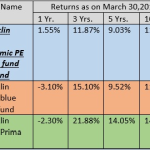

IDBI Tax Saving fund was recently launched in sept 2013.Though this fund do not have a long term performance history but after looking at selective stock picking ..beyond regular liquid stocks one can think to invest.This fund comprises of selective 25-30 stocks.

Fund Portfolio:

| Script | Current Market Price – CMP |

|

MRF |

19600 |

|

PAGE Industries |

6320 |

|

Blue Dart Express |

3302 |

|

Eicher Motors |

5426 |

|

TVS Motors |

87 |

|

Gruh Finance Ltd |

270 |

|

Sundaram Finance Ltd |

607 |

|

Pidilite Industries Ltd |

290 |

|

BATA India Ltd |

1050 |

| Dr.Reddys Laboratory Ltd |

2800 |

|

Colgate Palmolive I Ltd |

1315 |

|

Cummins India Ltd |

495 |

|

CMC Limited |

1500 |

|

Wabco India Ltd |

1850 |

|

VST Industries Ltd |

1590 |

| Cholamandalam Investment & Finance |

232 |

|

BOSCH Ltd |

9235 |

|

Nestle India Ltd |

4700 |

| Asian Paints Limited |

475 |

|

Glaxosmithkline Consumer Healthcare Ltd |

4300 |

| ING Vyasa Bank Ltd |

540 |

|

CRISIL Ltd |

1152 |

| Agro Tech foods Ltd |

475 |

|

Castrol India Ltd |

285 |

| Kotak Mahindra Bank |

675 |

Current market price provided for reference only.Stock List as per % Allocation.

One can view that this fund comprises of stocks which are fundamentally strong across different sectors and most of the companies are Zero debt companies.

So I am positive for this fund .Though this is tax saving fund with lock in period of 03 years any investor having longer term approach can think to invest in this fund.