LIC have recently re-launched term insurance plans viz. LIC Jeevan Anmol – II and LIC Amulya Jeevan II .You may have also seen advt in few of the newspapers.Both offers pure risk covers and offer only death benefit within policy term & no survival or maturity benefits.

Changes in mortality rates reflects in premiums as premiums have reduced in new launched term insurance plans.

What is basis diff between – LIC Anmol Jeevan & Amulya Jeevan :Basic difference is if you are looking for sum insured up to Rs 24 Lakh then you need to choose Anmol Jeevan and for Sum insured of above Rs.25 Lakh choose Amulya Jeevan.

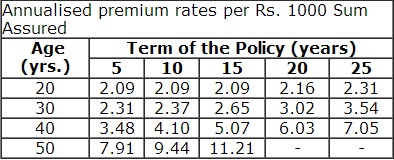

Premium Rates:Anmol Jeevan LIC’s website till don’t offer any premium calculation except information of premium per 1000 sum assured.

So for 30 yr male looking cover of Rs.20 Lakh ,with policy term of 25 years will have at least premium of Rs.7080 + service tax.(Exact premium for mentioned specifications not known till.–shall be updated)

Few Premium rates of other insurance companies:

| Plan Name | Annual Premium – 30 Yr old – Male,Non-smoker,Term 25 YrsSA:20 Lakh |

| Aegon Religare iTerm | 2620 |

| Bajaj Allianz iSecure Insurane plan | 3500 |

| Canara,HSBC Pure Term plan | 5300 |

| Edelweiss Tokyo Life protection | 4044 |

| HDFC CLICK2PROTECT | 3840 |

| ICICI PRU i-Care | 3580 |

| IDBI-Federal Term Insurance plan | 4365 |

| India first Online Term plan | 2761 |

| ING Term Life | 5327 |

| LIC anmol Jeevan | 7643 |

| PNB Met Term Assurance | 5700 |

| Reliance Term Plan | 4160 |

| SBI Life Saral Sheild | 5078 |

| Star Union Dai-Ichi – Pure Term Assurance Plan | 6402 |

| TATA AIA Life Raksha | 5280 |

so I guess,though premiums have reduced,Anmol Jeevan is not still cheap in comparison with other plans.

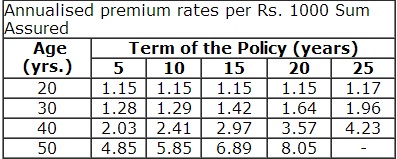

Premium chart for Amulya Jeevan:

Just check both premium charts .One can find that for 30 yr old and 25 yr policy term,premium rates are discounted.

so for 30 yr old,25 yrs term and for 40 lakh sum assured ,Minimum premium will be Rs.7840 + Service tax.(Exact premium not known till).

Premium for other insurance companies:For Rs.40 Lakh sum assured:

| Plan Name | 30 Yr old,Male,Non smoker ,40 Lakh SA,Term 25 yrs |

| Aviva i-Life Term plan | 5120 |

| Bharti AXA Life eProtect | 5000 |

| DLF Pramerica U Protect | 8200 |

| ICICI pru Pure Protcet Elite | 8554 |

| Kotak e-preferred Term plan | 4570 |

| Max New York Life Platinum Protect | 8120 |

| PNB Met surakshsha Plus | 8520 |

| SBI Life Smart shield – Term Assurance plan | 7144 |

| Star union Dai –Ichi Life Premiere Plan | 11000 |

so if premium for Amulya Jeevan comes up to even Rs.10,000 it will be good offering by LIC.

LIC Anmol Jeevan have max policy term of 25 Yrs so for 30 yr old,max cover will be available up to age of 55 only which may not be sufficient as one can expected to be covered up to age of 60 yrs.so in that context ,Amulya Jeevan looks to be better product for me.

Disclaimer : Premium rates as extracted from web aggregators and websites.Readers responsibility to check premium rates from authentic sources.