Money doubling or money tripling phenomenon is completely related to the psychology of the investor and thanks to it one can can view such schemes launched by Banks or such other financial institutions.

Money doubling is considered to be an important benchmark for growth of money.

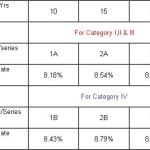

Today just we will have a look at how much interest rate one need to get so that money is get doubled and tripled.Returns are on compounded annual basis.

| Period In Years | % Returns needed to get money doubled | % Returns needed to get money tripled. |

| 01 | 100 | 200 |

| 02 | 41.50 | 73.25 |

| 03 | 26 | 44.25 |

| 04 | 18.93 | 31.61 |

| 05 | 14.88 | 24.58 |

| 06 | 12.25 | 20.10 |

| 07 | 10.41 | 17 |

| 08 | 9.06 | 14.73 |

| 09 | 8.01 | 12.99 |

| 10 | 7.18 | 11.62 |

| 11 | 6.51 | 10.51 |

| 12 | 5.95 | 9.59 |

| 13 | 5.48 | 8.82 |

| 14 | 5.08 | 8.17 |

| 15 | 4.73 | 7.60 |

Imp note : Compounding frequency used is Annual and banks are allowed to use frequency starting from quarterly.So most of the banks use quarterly frequency to calculate interest and period will be shortened in such case..E.g For 9% rate of interest,using quarterly compounding frequency money will get doubled in around 94 Months ..means just below 08 years.

Rest,we should have understood that there is no scope for money to get doubled for a period less than 07 years in case of any good or nationalized bank ..If you want to get then one don’t have any other option but to go with some riskier options like mutual funds or direct equity and take commensurate risk.