Power Finance Corporation – A Miniratna status Govt Of India company is engaged in the financing activities of power sector and related projects across the country.

PFC is going to raise Rs.750 crores with an option to retain the over subscription upto shelf limit i.e up to Rs.3875.90 crores.

Imp Dates:

- Issue Open Date:14/10/2013

- Issue Close Date:11/11/2013

Interest Rates:

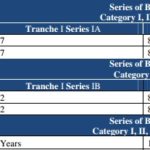

| Tenure – Yrs |

10 |

15 |

20 |

| Options |

For Category I,II & III |

||

| Tranche1/series |

1A |

2A |

3A |

| Coupon Rate |

8.18% |

8.54% |

8.67% |

| Options |

For Category IV |

||

| Tranche 1/Series |

1B |

2B |

3B |

| Coupon Rate |

8.43% |

8.79% |

8.92% |

Interest payout will annual only and no other payout or cumulative option.

Categorywise allocation:

| Category I | Institutional Investors | 15% allocation Of issue size |

| Category II | Non-Institutional Investors | 20% of total issue size |

| Category III | HNI – Individuals /HUFs/ NRIs Investing to a value exceeding Rs.10 Lakh | 25% of total issue size |

| Category IV | Individuals /HUFs/NRIs investing for Rs.10lakh or less. | 40% of total issue size. |

Allotment on first come first served basis.

Overall a good issue to invest – high safety and tax free annual income with good rate.