Muthoot finance – one of the leading Gold loan company which offers loan on Gold jewelry.Muthoot Finance have planned to raise Rs.150 Crore through this issue with an option to retain over subscription of the same amount.

Imp Dates:

- Issue Open Date:02/09/2013.

- Issue Close Date:16/09/2013.

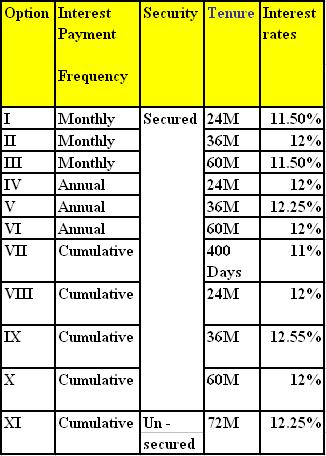

Muthoot finance NCD Interest Rates / Other Details:

so issue offers different options like monthly interest,annual interest as well cumulative interest option.With last option (XI) investor will get amount doubled within 6 years.

Security:

One can view that series I to X are secured and Series XI is of unsecured nature.Secured NCDs means investors would have first pari-passu charge on the identified immovable property as well on the assets of the company ,loans ,advances and other receivables.In case of Un-secured NCDs, investors will have sub-ordinated / lower rights.

Credit Rating:

ICRA AA- and CRISIL AA-.It indicates higher safety with lower rank.

Profits Reported by company:

| Year ended | Profit Reported In Crores |

| March 2008 | 63.07 crores |

| March 2009 | 97.87 “ |

| March 2010 | 228.51 “ |

| March 2011 | 494.18 “ |

| March 2012 | 892.02 “ |

| March 2013 | 1004.93 “ |

Performance of Gold loan companies mostly depends on the gold prices and other economic factors.so overall invest if you understand the risks involved for any Gold loan company and if you expects same performance in future as well.