There was a great craze of highest NAV guaranteed plan in the years of 2010 and 2011.

We have take a view of current NAVs and highest NAVs those have offered by these plans.

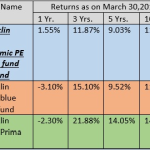

| Plan Name | Plan Launched Date | Highest NAV | Current NAV |

| Aviva wealth Protect | July2010 | 11.952 | 11.233 |

| Bajaj Allianz Max Gain | Dec-2009 | 12.5459 | 11.6222 |

| Bharti Axa True Wealth | Oct-2010 | 10 Min NAV Guaranteed by company at maturity =12 | 8.1013 |

| Birla SL Platinum Advantage fund | Feb-2010 | 10.95 | 9.8399 |

| HDFC SL Crest – Highest NAV Guaranteed Fund | Sept2010 | 10.9828 | 10.2834 |

| ICICI-Pru Pinnacle super – highest NAV Guaranteed fund | Mar-2011 | 11.24 | 10.29 |

| IDBI Federal Wealthsurance –MAXiNAV Guaranteed Fund | May-2011 | 12.0218 | 11.6776 |

| ING-Vyasa Market shield fund | Dec-2010 | 10.9216 | 10.5285 |

| LIC Wealth Plus fund | Dec2010 | 11.0526 | 9.8711 |

| LIC Samridhi Plus | Dec2011 | 11.8001 | 11.0596 |

| Reliance Life Guaranteed NAV Plan | Dec2010 | 12.1513 | 12.0092 |

| SBI Life smart Wealth Assure | Mar-2011 | 12.2006 | 11.5017 |

Few imp notes:

- Possibly there are great challenging conditions ahead across all the markets whether its bond market or equity market.Bond market is also witnessing severe volatility and tough conditions for fund managers.

- Though highest NAVs of few companies are more than that issued nav of 10 …most of the investors are likely in the loss though highest NAV is well ahead than issued NAV. This is because of premium allocation charges ,fund management charges ,mortality charges.companies charging few charges like premium allocation charges upfront which results in allocation of less premium while few charges like mortality charges are applicable through cancellation of units which results in reduction of units.