There are generally two easy ways of investing in Corporates bonds , Govt securities and other money market instruments:

- Open Ended Debt Funds

- Fixed Maturity Plans.

Today we will take a view at which factors one should consider before choosing either FMP or open ended debt funds.

Investment Duration: Investment duration is the most important factor to be considered by any debt fund investor.In case of FMPs most of the FMPs are being launched for the duration like 370 days or similar ..just above period of one year.

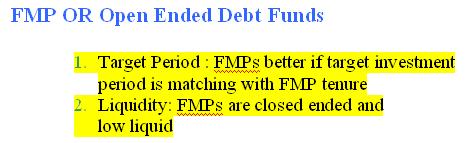

If you are a investor looking to invest for duration like one year then think for such FMPs offering period of just above one year.They can invest only in securities maturing within the period of the plan while general income funds can prove risky for this period.

Systematic Vs lumpsum approach: Its also important to know whether investor is looking to invest for lumpsum amount or systematically over a period of time.For SIP open ended debt funds need to be chosen .If SIP period is about 5-6 years then income funds or dynamic bond funds can also preferred.

Liquidity: If you are not sure about requirement of money wthin stipulated period then you need to chose open ended funds.Fixed maturity plans are closed ended plans . They are listed on the exchange but as volume is always at the low level this option is not suggested to redeem money through exchanges.So consider Liquidity factor before investing in FMPs.

Redemption: Advantage of FMP is that money will get credited in investors account as soon plan period is over.so money will be available for investor as soon target period is over.This may not be true for debt funds where investors need to manually redeem the investment.so there is more ease for FMPs as far as redemption is considered.

Taxation: Taxation issues shall be similar for both FMPs or debt fund investors.We have discussed taxation issues of mutual funds time to time.

so overall conclusion is that for lumpsum investment and if period is not very long then I will prefer FMP for the target period otherwise open ended debt funds are good if investment period is longer and if investment is through systematic way.