One of my friend have an habit of keeping complete cash flow records.This is great habit but problem is that he can not tolerate even if a single rupee is missing from the cash flow …. sometimes his life become misery as he tries to over-chase the productivity.

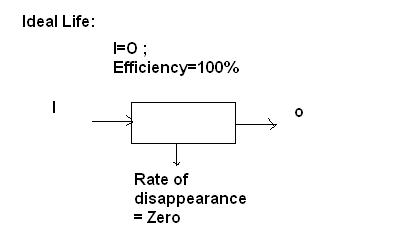

Ideal life is totally different from real one.

Suppose some one is earning Rs.12 Lakh in hand annually…its far difficult to trace the route of all this money.

Perfect money balance is possible only in ideal life where Rate of money disappearance is zero.In reality its not possible to have perfect cash flow.There will always some disappearance of money..Just one need to take care that this disappearance rate is within the tolerance limit.

When I watch financial planning programmes on TV and when financial planners claims the long term returns like 15-18% I just feels like cheating as its only ideal kind of returns…in reality there are number of risks equity investor faces – from investor behavior risk to market / country specific risks…which we never take in account.

100% productivity,100% yield, Zero NPA, Zero corruption,No fraud is possible only in ideal system and in reality things would always be different…