For longer term perspective its inevitable to have a place for bluechip stocks (Companies having higher market capitals) as volatility or speculations are comparatively lower in bluechip stocks and expected recovery is as well faster among bluechip stocks.

As far blue chip funds are concerned two funds always comes in investors mind:

- ICICI Prudential Focused Blue Chip

- Franklin India Bluehip Fund.

Today we will have some comparison between two funds.

Franklin Bluechip is very much old fund in operation since 1993 while ICICI Prudential Focused Bluechip is relatively new started in the year 2008.

SIP Return Comparison –

We will consider the period of last 05 years:

- SIP start date: June 10, 2008.

- SIP End date: June 10, 2013.

- Total installments: 61.

- Total Invested amount: 3,05,000.

SIP Returns Comparison:

Present Value Comparison:

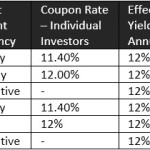

Return Comparison – Lump sum Amount:

Return comparison between two funds and sensex for last 01, 03 and 05 years.

So one can check that as far returns are concerned ICICI Prudential Focused Bluechip fund have consistently outperformed Franklin India Blue Chip – in case of SIP as well lump sum investments.

Franklin India Bluechip is a good fund and is of defensive nature .

There are operational similarities as well differences between these two.Both are bullish for banking sector & have highest allocation in banking stocks.ICICI Pru Focused Bluechip invests in relatively less number of stocks & so carries little bit higher risk as well.