General Objective of dynamic bond fund is to generate income while maintaining liquidity through actively managed portfolio of debt & money market instruments.

In general interest rate cycles can not be predicted accurately and so there is importance of Dynamic Bond funds which invests in instruments across different maturities and as well can rebalance portfolio based on current interest rate scenario.

IDFC dynamic bond fund is one of the successful fund since last few years & we will take a look at the same including the features of the scheme,Asset Alloation & Asset Quality.

Features Of IDFC Dynamic Bond Fund:

| Scheme Launch Date | Dec 2008 |

| AUM Rs.Crores | 6500 /- |

| Entry Load | Nil |

| Exit Load | 0.50% within 90 days.Nil Thereafter |

| Min Investment Amount | Rs.5000/- |

| Benchmark | CRISIL Composite Bond Fund Index |

IDFC Dynamic Bond Fund – Performance:

| Scheme Performance Comparison | IDFC Dynamic Bond Fund | CRSIL Composite Bond Fund Index |

| 1 Month | 2.84 | 2.5353 |

| 3 Months | 4.85 | 4.0022 |

| 6 Months | 7.95 | 6.6774 |

| 1 Year | 15.70 | 11.6066 |

| 3 Yrs | 10.77 | 9.05% |

Income from Debt funds is subject to long term capital gain tax @rate 0f 10% without indexation or 20% after indexation.

Click Here for Snapshot of taxation aspects of mutual funds

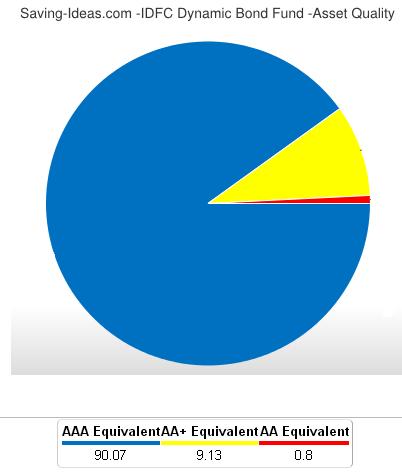

IDFC Dynamic Bond Fund – Asset Quality:

IDFC dynamic Bond fund have more than 90% AAA rating instruments means quality is good and credit default risk is low for the fund.

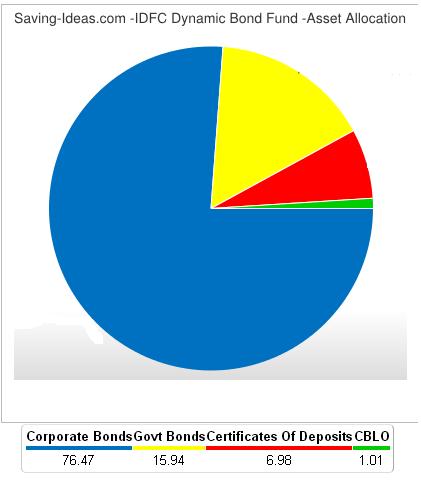

IDFC Dynamic Bond Fund – Asset Allocation:

Fund have combination of Good quality corporate bonds,G-sec,Certificate of deposits.

IDFC Dynamic Bond Fund- Average Maturity Period: 5.77 Yrs…which is also ideal.

Bond funds carries interest rate risk..but also it offers good opportunity to invest in bond and money market instruments where we common peoples won’t able to invest as much easily.So if you have understood the risk..dynamic bond funds are good to diversify the debt portfolio.

Hi Admin,

My name is Dan. I am a financial content writer and I have contributed many financial articles for numerous well established websites.

Today when I came across your site “saving-ideas .com “, I enjoyed reading some of your articles.Therefore, I am willing to share an well researched and copy-scape proof article for your informative site as well.

I am pretty sure that you will found my proposal interesting and will give me an opportunity to write for your site.

Please let me know your decision.

Warm Regards,

Dan Marshall

Thanks DAN for your interest.

Currently we are not accepting the guest posts.Any time in future when we start accepting the guest post I will surely contact you.

Thank you.