SREI Infrastructure Finance Limited (SIFL) has come up with a issue of secured NCDs of face value Rs.1000/- each with details as below:

Important Dates – SREI NCD Issue:

- Issue Open Date: 04/04/2013.

- Issue Close Date:25/04/2013.

Details of Series,Interest Rates:

| Series | I | II | III | IV | V | VI |

| Coupon Rate for institutional/non-institutional investors | N.A | N.A. | N.A. | 11.00% | N.A. | N.A. |

| Interest Payout frequency | Quarterly | Annual | Cumulative | Annually | Cumulative | Cumulative |

| Tenure | 3Yrs | 3Yrs | 3Yrs | 5Yrs | 5Yrs | 6Yrs + 6 Months |

| Coupon Rate for individual category | 10.35% | 10.75% | N.A. | 11.00% | N.A. | N.A. |

| Effective Yield Per annum | 10.75% | 10.75% | 10.76% | 11% | 11% | 11.24% |

| Maturity Amount Of Rs.1 Lakh | 100000 | 100000 | 135900 | 100000 | 168600 | 200000 |

Note: In case of non-cumulative options,maturity amount will be similar to invested amount as interest will be paid out periodically as option chosen by investor.

One can view that investor have wide range of choices.

For a period of three years,investor have quarterly,annual payment option as well cumulative @ 10.75% p.a/Cumulative.

For a period of 05 years,investors have option of annual interest as well cumulative @ 11% p.a./Cumulative.

For a period of 78 months there is cumulative option with interest rate @11.24% where investors money will get doubled.

Institutional / Non-Institutional investors can subscribe only for series IV & V.While general category investors applying up to one million (Rs.10 lakh) can subscribe for any series.

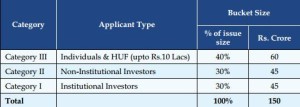

SREI NCD Issue Size:

Other details:

- Investors can subscribe through demat as well as physical mode.

- Credit Rating:CARE AA-/BWR AA – Both indicates less chances of default.

- NCDs will listed at BSE.

- Min Investment : Rs.10,000/- OR 10 NCDs.

BottomLine:

SREI is fairly old company involved in infrastructure finance & since interest rates offered are good enough & as it is secured issue one can think to subscribe for this issue.