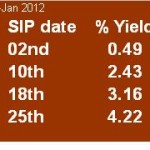

Two days back we have a post on different types of funds & their performance based on last 50 SIP installments.

While having the same post,by error I forget to mention the performance of balanced funds which is important category to be considered.

Balanced Funds – Mixture of Equity & debt instruments.Simple balanced fund can have a mixture as similar below:This combination can be changed depending up on surrounding condition.If suppose any fund house is bearish on equity then fund manager can increase debt component.

So just have a view on the best balanced mutual funds for last 50 installments where first installment was on 01/02/2009 & last installment on 01/03/2013.

| Name of balanced Fund | Per Month Invested Rs. | Total Invested – Last 50 installments | Current Value | SIP Returns – CAGR | % Equity Allocation of fund. |

| HDFC – Childrens Gift Fund | 3000/- | 1,50,000 | 2,02,136 | 14.95% | 71.99 |

| ICICI Pru Balanced Fund | 3000/- | 1,50,000/- | 1,95,039 | 13.12% | 66.10% |

| ICICI Pru Equity Volatility Advantage | 3000/- | 1,50,000/- | 1,94,008 | 13.08% | 65.31% |

| HDFC Balanced | 3000/- | 1,50,000/- | 1,91,651 | 12.23% | 69.34% |

| TATA Balanced | 3000/- | 1,50,000/- | 1,90,081 | 11.81 | 74.69 |

| HDFC Prudence | 3000/- | 1,50,000/- | 1,88,708 | 11.44% | 74.52% |

| Reliance Regular Saving Fund – Balanced Option | 3000/- | 1,50,000/- | 1,86,907 | 10.96% | 74.34% |

| Canara Robeco | 3000/- | 1,50,000/- | 1,86,204 | 10.76 | 72.37 |

| Birla Sunlife-95 | 3000/- | 1,50,000/- | 1,84,455 | 10.29 | 70.82 |

If you check last column of above table which indicates % equity allocation of balanced funds one can conclude that its average 70% in equity & I think it will be at any point of time.

Here we have selected only few funds who have able to deliver double digit SIP returns for last 50 installments.Hopefully,this table will help readers to select a good balanced fund for SIP purpose.