PNB Housing Finance Limited – PNBHFL -A subsidiary of Punjab National Bank & involved in the housing finance activities like Home loan,home construction loan,Home plot loan,loan against property etc.

PNBHFL was started its operation in the year of 1988.

PNBHFL accepts public deposits which are rated as FAA+ which indicates the higher level of safety of deposits.

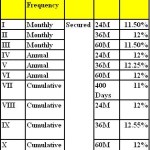

PNB Housing Finance was recently reduced their deposit rates & current deposit rates are as follows:

Current Interest Rates:As on 20th April, 2016

Period Months |

Interest Rates |

12-24 Months |

8.00% |

36-84 Months |

8.25% |

120 Months |

8.10% |

- Special Deposit scheme:

|

Tenure –months

|

Cumulative option interest |

|

|

15

|

8.05% |

|

|

22

|

8.05% |

|

|

30

|

8.35% |

|

|

44

|

8.45% |

-

Profit Hisory:

Financial Year Ended |

Profit After Tax in Lakhs |

Dividend |

March 31,2009 |

5341.23 |

20% |

Mar 31,2010 |

6676.12 |

20% |

Mar 31,2011 |

6937.30 |

22% |

Mar 31, 2012 |

7520.24 |

22% |

-

Other Details:

- Interest rates are compounded Half Yearly or interest payable half yearly.

- 0.25% extra for senior citizens & employees.

- Non-Cumulative option – Monthly,Quarterly,Half Yearly,Annual interest payout options available with discounted rates.

- Min deposit amount for cumulative option is Rs.10000/- & its Rs.20000/- for half yearly interest payouts.

- Loan facility upto 75% of deposit available from all branches of company.

- Premature withdrawal is possible after completion of 3 months.If deposits withdraw after 3 months & before completion of 6 months,no interest will be payable.If deposits are withdraw after completion of 6 months but before expiry of 12 months then fine of 3% & if deposits withdraw after 12 months but before expiry then there is fine of 2% on original deposit rates.