Last week Insurance Regulators have approved few important regulations for insurance companies.These regulations are summarized as below:

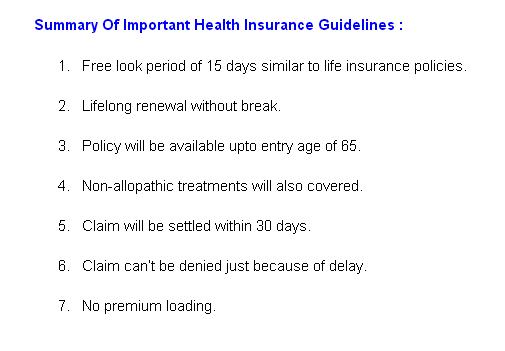

IRDA have approved new regulations for health insurance companies.As per new guidelines all health insurance policies will now provide for entry age of upto 65 years & will not have any exit age for renewal,if policy is continuously renewed without any break.Life insurance companies can sell health insurance products for term of at least four years while General insurance companies can offer product for not more than three years.

Next important regulation is no loads would be charged for renewal even if there is a claim in preceding year.

Now For senior citizens premium charged should be transparent & justified.

IRDA approval will be needed for helath insurance companies to withdraw the products where interest of existing policy holders will be maintained & they will have option to switch over new similar policy.

If any policy holder wish to avail portability feature then he should apply to the health insurer at least 45 days from the premium renewal date of existing policy.

Insurers will not able to deny claims on the basis of delay unless its deliberate as well they need to settle the claims within stipulated time of 30 days.

IRDA have also approved the regulations related to the investments made by insurance companies.They are allowed to increase their equity exposure company in the company from the present level of 10% to 12% and 15% depending on the fund controlled by insurance company.

As per new approved regulations,new set of KYC procedures will also applicable for the policy holders.

IRDA is also in process to set the changes in the Bancassurance channels where insurance products are channeled through banks.

Press release of IRDA dated Feb 08, 2013 can be viewed here.

Summary Of New Health Insurance Guidelines: