Recently,Reserve Bank Of India [RBI] directed PSU banks to promote online transfer processes like NEFT and RTGS and minimise uses of cheques as cost cutting measures.MICR area of cheque is important from point of view of speedy processing and cost of cheque manufacturing.

MICR [ Magnetic Ink Character Recognition]:

MICR line is magnetic ink printed characters of specific fonts which can be recognized by high speed magnetic recognition equipment.Its used for faster processing of paper instruments like Cheque / warrants / IT refunds Etc.MICR codes are printed using special MICR toners which are formulated with a special grade of magnetic iron oxide,which can generate magnetic signal.

MICR line or MICR area is always at the bottom of the cheque leaflet.

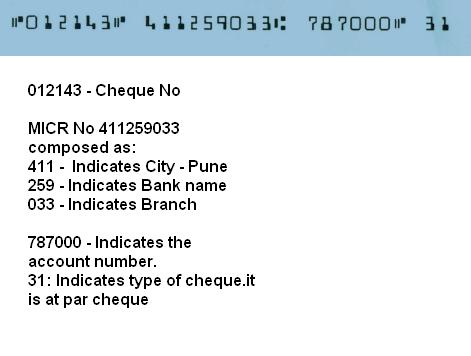

Consider Example of MICR Line:

MICR Line Structure:Diffeterent parts of MICR line A,B,C and D are as follows

A ] This is 6 digit cheque number.

B] This is known as Sort field or in general called as MICR number.This is a 9 digit number and its combination of City Code,Bank Code and Branch Code.

First Three digits indicates city code:

Few examples of city codes:

| City | City Code |

| Mumbai | 400 |

| Pune | 411 |

| Banglore | 560 |

| Kolkata | 700 |

| Hyderabad | 500 |

E.g. Any cheque from Pune will have initial code 411.

Next three indicates the bank code:

Examples of Bank code.

| Bank name | Bank Code |

| SBI | 002 |

| HDFC | 240 |

| ICICI | 229 |

Eg Any cheque from HDFC bank will have bank code 240 or ICICI bank will have bank code 229

Last three digits indicates branch.

Thus this 9 digit is specific for each branch of any bank

C ] Account No Field : This 6 digit field is optional and indicates the account number.It may or may not be present in MICR line.

D ] Transaction Code field : This is 02 digit field.It is different for different type of instrument.

| Nature of instrument | Transaction Code No |

| Saving Account chaeque | 10 |

| Saving account At Par Cheque | 31 |

| Current account cheque | 11 |

| Dividend Warrant | 14 |

| Gift Cheque | 18 |

| IT Refunds | 49 |

E.g. Code number “10” indicates saving account cheque,”31″ indicates multicity at Par cheque.

E ] Amount field is encoded in 13 digits and in terms of paise without decimal point in the field next to transaction code field.

MICR line cheques are created through specially used printers and needs to be created as per standards specified otherwise it will not be encoded by MICR encoders.Since MICR is machine readable process,each character needs to be free from any irregular marks from front as well back side and one should take care of that.One may have understood the perfection and costs of manufacturing of MICR cheque leaflets and should prefer to use electronic transactions…isn’t it? What do you think?