//for details of IIFL SEPT 2013 ISSUE CLICK HERE

India Infoline Finance Limited – Issue Of Non -Convertible Debentures of size 250 Crore with an option to retain over subscription of Rs.250 Crore ,total aggregating Rs.500 Crore.

The NCDs are of unsecured in nature of subordinated debt and will be treated as Tier-II capital.

India Infoline Finance Company Limited – Part Of IIFL group which offers basket of products like loan against gold,properties,securities and other financing activities to retail and HNI clients.

Important Terms of NCD:

- NCD start Date – Sept 05, 2012.

- NCD Closing Date – Sept 18, 2012.

- NCDs are proposed to be listed at NSE and BSE.

- Issuance – Both in Physical / Demat mode.

- Face Value – Rs.1000/-.

- Min application amount – Rs.5000/- or 5 NCDs.

- Credit rating – AA- from CRISIL & ICRA.Both indicates Stable rating.

- Tenure – 72 Months.

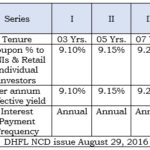

| Options | I | II | III |

| Interest Payment Frequency | Monthly Payout | Annual Payout | Cumulative |

| Interest rate % | 12.75 | 12.75 | 12.75 |

% Allotment for Resident individuals-

50% of the total issue size.Further divided as 25% for investment upto 5 lakh and 25% for individuals with investment of more than 5 lakh.

As already mentioned,company will treat NCDs as subordinated debt i.e.debt of lower importance and ranked down.Risk and rewards always put their hands together and interest rates are higher with risk of subordinated debt.Monthly interest option looks attractive for me.Finally, investor needs to judge risk capacity and take appropriate decision.

Subscription Updates of India Infoline Issue –

India Infoline Issue sept 2012 is oversubscribed.Till this update,applications for Rs 616 crore were received against issue size of Rs.500 crore and last date of issue is updated as 07th Sept. 2012.

dear sir,

tumare iifl me kisika dyan hai ya nahe kon kya karta hai usiko nahe malum hota probelm resolved karte hai ya garden me gumne ke liye aate hai mera 1 month passward ka problem chal raha hai or evry day muje kush na kush kahke phon rakh dete hai muje iifl ke ceo ka mail id chaheye

thaks

when is the ncd going to list what is the bse code for sep 2012 isue

Hi, need to check. I in general do not track listing etc .

Thanks for your comment.

1062 p.m.

How to invest directly through internet banking ?

I think you can apply online thorugh demat account.Please check it with your broker whether this facility is available with him or not.Otherwise submit physical application.

Can I resale it any time, if yes then whether price will change or will be the same all the time?

No.Yield may be higher or lower..

i want one of gurunteed bond for tax saving purpose

This year 80-CCF tax saving bonds are not available.

One can invest tax free bonds where interest received is tax free..

i want 1 of guarunteed bond for saving purpose.

what amount we will get as interest if we invest 100000 on monthly interested scheme

Apprx.Rs1062 if tax is not deducted at source.or if you take it in demat mode.

Hi,

For Rs. 100000 investment investor will get 10625 interest p.m. you will be considered under 25% allottment category as HNI for investment above 500000 Rs. i am manager advisor with India infoline and have all details for this issue..please contact for more info

Hi,

I think, for 1 lakh investment monthly interest payout will be Rs.1062… for 10 lakh it will be Rs.10625/-

Yes, my mistake for 10 lacs its 10625 per month

Mistake do happens from everyone..

1062

is this eligible for tax savings.. Can I consider them as tax saving bonds..?

No.This is not for tax saving purpose.

Yes it is not as tax saving instruments but you can do tax planning in legitimate way to avoid any taxes as company won’t deduct any TDS on interest it is upto you to pay tax..for more info you may contact me as i am a ca and employee with india infoline.

Hi Anuj,

What is your India Infoline email ID.

Please dont give personal email ID, only the official one with India Infoline.

Thanks

Sanjay