Effective from 2006,one more instruments was added in 80C section of Income Tax (though its already overcrowded) and it was Tax saver fixed deposit.Invest in bank deposits for 5 yrs and get tax benefit u/s 80C.

Today we will take a look at such tax saver fixed deposits,how they differ from normal fixed deposits,what are current interest rates and other information.

First take look at the key factors about tax saver fixed deposits:

- Tax saving u/s 80C:As far safety factor is considered investments in NSC,PPF and fixed deposits are to be considered safe.There are few minor differences in their overall functioning.Interest received in ppf and NSC is annual compounding and accrual basis only.Interest reinvested in NSC as well qualify for 80c benefit.This is not the case for tax saver fixed deposits.Interest reinvested under cumulative option do not qualify for 80c benefits but One can takeout interest payout quarterly,half-yearly or annually.Few banks also allow monthly interest payout.But one need to choose the option while submitting the deposit form and as once its chosen,,can not be modified.

- Most of the banks allow to open tax saver deposits without having saving account with them subject to choice of cumulative mode.

- Banks do not allow overdraft facility or loan against these deposits as it will make lock in period irrelevant.

- These are not the Reinvestment types of deposits.Means after completion of 5 yrs,deposits will not be auto-renewed.

- Interest offered is generally similar to the general fixed deposits and will not get any higher rates though there is lock in of 5 yrs.

- Similar to other deposits,Interest received is of taxable nature and tax will be deducted at source as per provisions of laws.

- In case of joint deposits,income tax benefit is available for first holder only.

- Its not possible to encash or withdrawal of tax saver deposits before completion of 5 yrs.

- One can invest min Rs.100/- and maximum Rs.1 lakh in financial year.

Interest Rates offered by few of the banks for tax saver fixed deposits are as follows:

| Sr.No | Bank Name | Interest Rates(%) | For Senior Citizens(%) |

| 1. | IDBI Bank | 9.25 | 10 |

| 2. | SBI | 8.75 | 9.25 |

| 3. | HDFC Bank | 9.25 | 9.75 |

| 4. | ICICI Bank | 8.50 | 9.25 |

| 5. | Bank OfBaroda | 8.50 | 9.00 |

| 6. | Indian Bank | 9.00 | 9.50 |

As far tax saving is concerned,this is the best instrument for any conservative investor.Its easy,convenient.But general observation is that banks are not much eager to market it out…can’t say any specific reason but they may not want to take commitment for longer period of 5 yrs,especially when interest rates are at higher level or possibly also banks wish to push different tax saving instruments like ULIPs…..don’t know.

Also View:

- PPF Or Fixed Deposit For 80C Benefits:

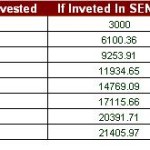

- Cumulative Flow Of PPF And Fixed Deposits After Paying Off The Tax:

Last line looks true..Now a days ,banks are interested in insurance products more than their own.

Yes.Banks generally encourage customers to invest in Unit Linked Plans of their associated company…rather their own fixed deposit schemes.

Thanks for the comment.