// There is an important amendment for REC Tax Free Bonds.As per Gazette Notification issued by the Ministry of Finance,”Any individual investing upto Rs 5 lakh in REC Tax Free Bonds will be treated as retail investor and investing more than 5 lakh will be treated as HNI”

(It was earlier declared as 1 lakh)

Rural Electrification Corporation (REC),Govt of India undertaking Navratna company has come up with a issue of secured,tax free bonds of size 1500 crore with option to retain oversubscription of upto 3000 crore.Interest received from these bonds will be tax free u/s 10 (15) (iv) (h) of I.T Act 1961 and it will not be a part of the income of the investor.

Issue Details:

- Issue Open Date: 06th March 2012.

- Issue Close Date:12th March 2012.

Other Details:

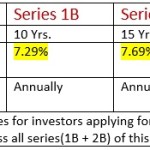

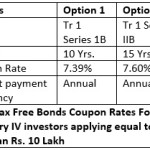

| Options | Series-1 | Series-2 |

| Tenure | 10 Yrs | 15 Yrs |

| Interest Payment | Annual | Annual |

| Face value Rs/Bond | 1000 | 1000 |

| Min Application | 5000 [5 Bonds] | 5000[5 Bonds] |

| Put/Call Option | None | None |

| Interest rate for Cateogary I and II [% p.a.] | 7.93% | 8.12% |

| Interest rate for cateogary III | 8.13 | 8.32 |

Cateogaries:

| Cateogary I | Cateogary II | Cateogary III |

| QIB & Corporate | Individuals / HUFs applying for more than 1 lakhs | Individuals/HUFs applying for less than Rs 1 lakh |

| Upto 50% of overall issue size | Upto 25% of overall issue size | Upto 25% of overall issue size |

|

Allotment on first come first served basis. |

||

Other Highlights:

- Credit ratings: “AAA” from ICRA,CRISIL,CARE.

- Bonds will be issued in demat mode only.

- Interest on the refund money will be at rate of 5% p.a.

- Important thing is that this is NOT 80-ccf issue and no tax benefit will available on principal invested in this issue.

Sir,

I need information on tax free bonds in Fy 2012-2013

Hi,

Still there is no notification about Tax free bonds.