As name indicates,in systematic transfer plan ,a fixed capital with fixed frequency get transferred from one scheme to another.

The scheme in which lumpsum capital is invested and from which money gets transferred is “Transferor Scheme” while scheme in which money gets transferred is “Transferee Scheme”.

Ideally,liquid fund of the respective fund house is transferor scheme while equity fund is the transferee scheme in which money is transferred systematically.

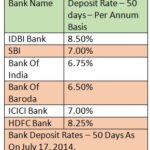

Here we will consider a case study with following specification:

- Transferor scheme: Reliance Liquid fund (Growth Option).

- Transferee scheme: Reliance Growth Fund.

- STP Frequency: Monthly.

- Initial lumpsum amount invested in liquid fund: 2 lakh.

- Monthly amount transferred: Rs.2000/-. from 10th April 2007.

- Period considered: Rs.2 L deposited in liquid fund on 10th March 2007 and Rs.2000/- per month transferred in Growth fund from 10th April 2007.

As capital is get transferred from liquid fund to growth fund(i.e.Units of liquid funds will be redeemed and units of growth fund are purchased at prevailing NAV),units in liquid fund will continuously decreased while units of the growth fund will continuously increasing.It can be as shown below:

Please Note:

In above Graphs Data as on 10th March every year is shown only…It do not show the in between fluctuations.

Overall Scenario:

| Name | Amount Invested | Value as on 10th Mar 2012 |

| Reliance Liquid Fund | 200000 | 1,27,356 |

| Reliance Growth Fund | Rs.2000/- Transferred P.M. | 1,45,843 |

Overall Yield:6.5% CAGR.

Benefit of STP is that chances are always high that liquid funds will offer better returns than that of saving accounts and it affirms that the capital invested in liquid fund for purpose of STP will be used for this purpose only,which is not guaranteed for capital in saving account used for SIPs.