IFCI has come up with their 80-ccf tax saving issue on 29th Feb.2012.It is open till 30th March 2012.

Last Date of the issue is extended till30th March 2012,till bank closing hours.

[This issue is closed …so please do not enter the details now.]

To download the form just enter your email address and you will receive an autogenerated E-mail with mention of form download link.

E-mail id is just for to avoid anonymous downloads of application forms..

//Last Date of issue is 30th March 2012,though its printed as 27th March on the application form,it doesn’t matters.

Please read the instructions below first.

Please Note:

- After you hit the submit button you will receive the auto generated e-mail (PLEASE CHECK SPAM FOLDER) .you can just reply to that mail if you have any query or doubts.

- We do not keep track of email ids provided here.

- Investment in Infra bonds is only one time investment…like fixed deposits…Its not like insurance policy where one need to pay for each year..Investor can decide for next year whether he want to invest or not.

Collection centres:

General Form Filling Instructions:

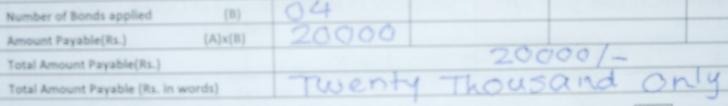

- Start the form filling from “Number of bonds applied for(B):” As face value of the bond is 5ooo, for investment of 20000 total bonds applied will be 04….You can apply for min 1 bond…..For 04 bonds (Rs.20,000) it will be look like this.

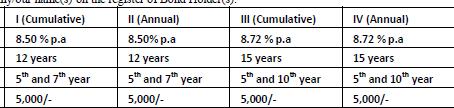

- There are four options..as shown below:

- If you are going to take demat mode then enter DP-ID / Client ID Details accurately.In case of physical mode,ignore the table.This DP-Id / Client Id details are available on the communication received to you from the broker or also you can call your broker and ask about it.

- Just find the different fields: Applicants Name,Bank account details,Pan No,Cheque details,signature. etc.

- Enter MICR Code (09 Digit) available on the cheque..immediate to the chq no .in the space tagged as “NECS/ECS payment” in the application form.

- Draw cheque in favor of “IFCI Ltd-Infra Bond”.

Documents:

- Self attested copy of address proof(List is available on second page of the form)

- Self attested copy of pan card.

- Cheque in favor of “IFCI Ltd-Infra Bond”.

- Cancelled copy of cheque.

- In case of demat mode,only self attested pan card and cheque is required.

- Cheque in favor of issue,

- application form,

- Copy Of Pan Card,

- Copy Of Address Proof,

- cancelled cheque……and submit it at the collection centre.You will receive an acknowledgement slip and you need to retain it.

What is Maturity Value:

- For I cumulative Option:

| At the end of | Value Of Rs.20,000/- |

| 5th Year | 30,076 |

| 7th Year | 35,404 |

| 12th Year | 53,236 |

- For III Cumulative Option:

Exit / withdwawal money is possible after 5th, 10th and 15 th year.The maturity amount will be as follows:

| At the end of | Value Of Rs.20,000/- |

| 5th Year | 30,380 |

| 10th Year | 46,148 |

| 15th Year | 70,096 |

What is money withdrawal procedure:

As per standard procedure,investors receive the intimation period from the registrar before exit window option available.Most of the times investor need to surrender the bonds (if opted for physical mode) by registered post /courier and after completion of the exit window period money get credited by ECS / warrant.

Other Ongoing 80-CCF Issues:

Dear sir,

Pls let me know when IFCI Infra Bond Series-V allotment is due

Don’tknow exactly when it will open.

But deemed date of allotment will be 31st March 2012 only i.e it will be considered in financial year 2011-12.

None

Some mails with company name extension may consider it as spam and may not allow the entry..so try with personal email.

Also CHECK THE SPAM.