I think,one can easily calculate the things for lumpsum investments..but when its question of monthly systematic investment then I think we have very limited things to do.We all know that Gold is on fire since last 10 yrs as well sensex also.I would like to share the results which asset have performed better for systematic way.

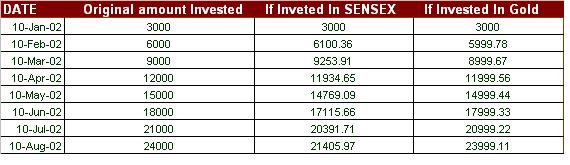

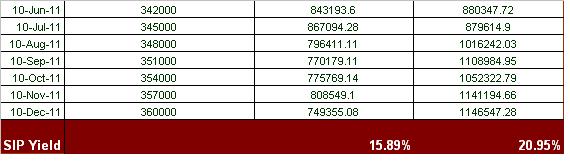

Here we assumed that Rs.3000 per month invested in SENSEX and Gold (International prices) from Jan 2002 to Dec 2011 on 10th of each month.

As Complete sheet is too lengthy,I have shown Topmost and Bottom part of it only.

We can also show the results Graphically:

One can view that Gold has performed better that sensex in last 10 yrs for systematic investment …But for different period we can also prove that equity is a better investment than Gold.

We should not draw any conclusion from above calculations.Gold is international commodity and prices are affected by overall global situation unlike local events for sensex.So rather Gold or Sensex proper diversification among different instruments is quite important,isn’t it?

Disclaimer:

As far we believe,data and calculation shown above is true and accurate but blog author denies any responsibility about accuracy of calculation presented above and any decision taken based on that.

Yes I am agreed with it , that if someone is taking a policy for 10 years and its monthly, It is so sure that invester will get almost 12%-15% return and deffrence between gold and investing in equity through Life Insurance is that you will get Insurance through the policy and you will get good return also IF you are planing to invest fo 10 years.

Thanks for your comment.

But here we have not said anything about investing in equity through life insurance scheme.

If you are talking about ULIPs,then I think Yes,,it may be beneficial if investment is made consistently.

Thanks for sharing.

Hi,

Nice to see your comment.