Reliance Gold Savings Fund,a fund of fund scheme which invests in units of Reliance Gold ETFs will complete the first year.This was the first type of Gold fund from any mutual fund house,so was heavily discussed and criticised.

We will take a view where it is today wnen nearer to completion of one year.

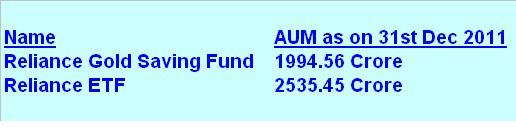

Asset Under management:

Source: Valueresearchonline.com

AUM shows that significant part of Reliance Exchange Traded Funds comes from Reliance Gold Savings Fund.

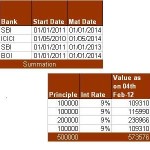

SIP performance of the fund [10th March 2011-10th Feb 2012]:

We will assume that Rs.5000/- invested in Reliance Gold Savings Fund and Physical gold on 10th of each month for last one year.Then comparision on the charts can be shown as follows.

SIP Yields of Physical Gold And Reliance Gold Savings Fund:

| Name | % SIP Returns | Value Of Rs 5000 pm Invested [Rs] |

| Physical Gold | 24 | 67545 |

| Reliance Gold Savings Fund | 23.3 | 67330 |

NAV Chart Of Reliance Gold ETF:

NAV Based Returns of Reliance Gold ETF:

Reliance Gold Savings Fund NAV Graph:

NAV Based Returns of Reliance Gold Savings Fund:

Important Notes:

- Purpose of the post is not to prove that Gold savings fund will perform better than ETF.It will mostly depend upon how much capital will fund manager deploy in ETFs.Currently nearly 98% fund is deployed in ETFs and remaining in cash and money market instruments.Expense ratio of resepective schemes is incorporated in NAVs.

- Equivalant NAVs of Gold saving funds are declared on next days.But this factor may be in favor of ETF investor as well as Gold fund investor.

- There will be buy/sell brokerage charges for ETFs and applicable exit loads for gold funds depending upon the scheme.Effect of theses parameters have not considered.

- My personal opinion is that gold funds will be better performers in falling market as there is not 100% capital invested in the gold market.

- Above dates have taken for calculation purpose and may or may not be available for investment.

- Please take advice of certified professional before investing in any of the instruments.I am not responsible for any errors / omissions in the above calculation.

- This post was prepared on 13th Feb 2012 so NAV values till 10th Feb have considered..there is not any other purpose of consideration of NAV dates upto 10th feb only..

what is the stat est of my gold fund

I have not been familiar with ETF, but I buy using savings account as I think it has the flexible so you do not lock you funds in event the gold price is not moving in your favour.

good info. Have you considered the charges and fees for the Reliance Gold Savings fund? Can you share details if you have – like if I invest Rs 10000 in rgsf, after 1 year if I sell it, what is the actual value after all the fees etc?

Hi,

NAV shown carries the expense ratio.There are no charges and fees unless your broker charges extra fee.Just there will be exit load of 2% if units are redeemed before completion of 1 yr.

If you are looking to invest for mere one year then I think to invest in this fund is not a great idea…returns will be as per fluctuations in the gold prices and can not be predicted earlier.