Currently there are more than 35 Asset management companies operating in India and so number of ELSS schemes.Its not possible to have all ELSS schemes and so will consider only few among them:

We will consider following scheme for comparison:

- Canara Robeco Tax Saver.

- Reliance Tax Saver.

- Franklin Templeton Tax Shield.

- HDFC Tax Saver.

- ICICI Prudential Tax Plan.

- SBI Magnum Tax Gain.

I was interested in few more schemes but its creating color blindness in the following graph so they have deleted.

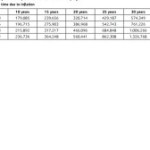

Initially we will compare the performance for last 3 yrs..

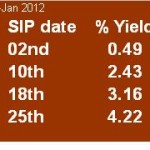

Here we will assume that investor have invested on 10th of each month through SIP from 10th Feb 2009 to 10th Feb 2012 and results are as shown below.

| Sr No |

Scheme |

% Annualised SIP Returns |

| 1 | ICICI Pru Tax Plan | 13.75 |

| 2 | Canara Robeco Tax Saver | 13.60 |

| 3 | Franklin Tax shield | 13.35 |

| 4 | Reliance Tax Saver | 12.40 |

| 5 | HDFC Tax Saver | 12.15 |

| 6 | SBI Magnum Tax Gain | 6.5 |

| 7 | Sensex | 6.8 |

Above data shown is for 3 yrs..Comparison for last 5 yrs and more will be somewhere in next post.