Muthoot Fincorp Limited is a finance company catering to the financial needs of retail and institutional customers,It is registered with Reserve Bank Of India as a systematically important non-deposit taking non-banking finance company.It has a mix of retail product offerings which includes Gold loans,home loans,auto loans loans against property,investment products and advisory services.

Objective:

The borrowing programme will be uitilised only for augmentation of working capitals of the company and general corporate purposes.No part of the proceeds of the issue would be utilised by the issuers directly/indirectly into capital markets or real estate purposes.

NCD Issue Details:

- Issue opened on: 30 Nov. 2011.

- Issue Close date: 31st Dec 2011.

- Issue Size: Rs.50 Crore.

- Credit rating: “A+” from CRISIL which indicates adequate safety of the instrument.”+” indicates the issuers position in the cateogary.

- Security:Security cover of 1.10 times for entire period of NCds will be provided by company.

- Face value: Rs 1 lakh.

- Min Investment: 1 Debenture or Rs 1 lakh.

- Holding: In demat mode only.

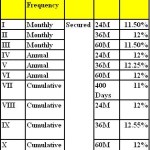

Interest rates:

| Period | Interest rates |

| 18 Months | 12.75% |

| 36 Months | 13% |

Interest is only annually payable.There is no cumulative option.

Company Financials for last 5 Yrs:

| Year | Net Profit(lakh) |

| 2006-2007 | 1916.63 |

| 2007-2008 | 3920.52 |

| 2008-09 | 5330.73 |

| 2009-10 | 12278.94 |

| 2010-11 | 25832.94 |

This issue carries medium safety(cover of 1.10 times is provided by the issuers), but offering quite better returns.In that sense one can take their investment decision.

For details of Muthoot Finance NCD issue starting from 22 nd Dec.2011 and interest rate of 13% PLEASE CLICK HERE

can a student invest in it?

sure return occurs here or not

Yes.Students can apply.If he is minor then guardian details are required.