L&T has come up with issue of tax saving infrastructure bonds Tranche 1.This issue will carry tax benefits U/S. 80CCF upto Rs. 20,000/-.

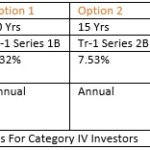

Issue Details:

- Open Date: 25th Nov. 2011.

- Issue Close Date: 24th Dec.2011.

Interest Rate:

Interest rate offered by issue is 9%.

Investor can choose to take annual interest payment as well cumulative at the end of bond maturity or buy-back period.

- Lock in period is as usual of 5 yrs.

- Face value of bond is Rs.1000/-.

- Bonds will be listed at BSE and can be traded only after lock in period of 5 yrs.

- Buy-back date: First working day after completion of 5 yrs.and first working day after completion of 7 yrs.

- Documents required to apply are as usual i.e.Self attested pan card,address proof and cancelled copy of cheque for physical mode and self attested pan card for demat mode.

- A/C pauee Cheque should be made in favor of “L&T Infra Bonds 2011B” .

I am Pune based sub-broker of the issue.If you want application form at your e-mail address email me on: ppdeshpande123@gmail.com.

I want to purchase L&T Infrastructure Bond. Please let me know from where i can purchase.

What return I will get? I am in Hyderabad.

Let me know the last date & is there any extension for submission.

No.L&T last date is over on 12th March.

last date of infrastructure bonds

Hi,

L&t Issue will close on 12th March 2012.

PFS issue will close on 16th March.

IFCI series-5 will close on 27th March 2012.

You can invest in any one of the either.

Interested to buy L&T Infrastructure bonds, please advise

Hi,

Last Date is 12th March.Please check mail.

Paresh

Interested to buy L&T Infra Bonds, please suggest

I want to purchase Bond.Please let me know from where i can purchase?

What return i will get? I am in Mumbai (Goregaon).

I want to buy L&T Infra bonds asap. Let me know how can i do that?

If you are in Pune then call me at 9225965529

Want to invest in infastructure bond in Bangalore. Can some one reach out to me for closing on this…

accrued interest on infra bond taxable or not taxable?

Its taxable.One can show it annually or at maturity as well.

Dear sir,

Please tell me If take Minor A/C then tax benifits given

M-9427583701

Sir,

we can not take the bonds in the name of minors.Even if any issue allows it then also it in not benefitted in any way.Finally interest earned will be clubbed with your income only.

Bonds can be purchased in the name of Minor by parents. If yes then what documents shall be required.

No.Bonds can not be purchsed in the name of minor.