IFCI is the first institution in India to cater long term finance needs of infrastructure sector, was incorporated in 1948.The company is engaged in infrastructure financing through IFCI Infrastructure Development ltd(IIDL).IFCI has come up with a new issue of subordinated bonds as of following details.

Issue Details:

- Issue open date: 05 th Sept – 10th Oct.2011.

- Nature of bonds:1,50,000 subordinated,unsecured bonds in the nature of promissory notes,the claims of the investors being subordinate to the claims of other creditors.

- Face value per bond: Rs.10,000/-

- Minimum Application : 10 bonds or Rs 1 lakh.

- Listing: NCDs will be listed at BSE.

- Credit rating:BWR AA-(stable),CARE A(stable) and ICRA LA(stable).

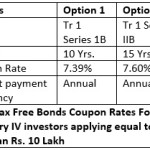

Interest Rates:

Individuals investing upto Rs.5 Lakh:

Interest rate: 10.60%.(cumulative or annual interest payment).

All other investors with tenor of 10 yrs:

Interest rate: 10.50% payable annually.

All investors with tenor of 15 yrs:

Interest rate: 10.75% payable annually.