Silver has become a popular market for investors and traders in recent months.Multi commodity Exchange Of India is No.1 in silver trading among all other international markets.High liquidity,momentum and volatility are the key attractions of silver.Though electronic silver market is attractive,major investment banks,hedge funds,brokerage houses dominates the market and quickly incorporates the global events.so to trade effectively beginners must have understandings of news,events and factors that affect the silver prices.

Silver Production:

Mexico is the largest silver producer country,followed by Peru,Poland,China,Chile,Australia and United States.India is silver importer as production is not suffieient.

Silver Uses:

1.Industrial: Silver is widely used in chemical,photo-electric ,Electronic industies.

2.Home Appliances.

3.As a Precious metal along with Gold have a great storage value.

Silver History:

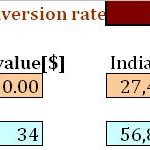

In 1979,following inflationary pressures Hunt brothers speculate the market and take the prices to the peak of $50.COMEX intervened and prices collapsed upto $8 within few months.Thereafter silver prices are trading in range bound mode from $20 -$8.In 2011,again prices skyrocketed to ealier peak of $50 and are currently trading at $34.

Factors Affecting Silver Prices:

1.Inflation: Silver has always remained preffered hedge against inflation.Investment bankers,hedge funds buys silver to prevent capital erosion because of inflation.After federal reserve decided to print more and more money,inflation pressure grows and silver peaked upto lifetime high.

2.Dollor Index: In general,silver prices trends opposite to dollor index.

3.Economic Indicators: United States being the biggest economy of the world,silver prices takes clue from economic announcements made in U.S and European countries.Most relevent indicators include Non-Farm Payrolls, GDP,Unemployment claims,Unemployment rates,Home sales data,Manufacturing index,Trade balance etc.

4.Demand-Supply: Sometimes demand-supply ratio changed due to different factors like mine strikes,geological tensions,government regulations etc.whenever supply is less prices tend to move upward.

Its difficult for anyone to earn money trading silver daily.But considering growing inflation and demand insight investors can think to buy silver at lower levels in electronic form at multi-commodity exchage where traders can buy silver of 1Kg,5Kg,30 Kg and at National spot exchange where investors can buy it in multiples of 100 gram,, to get good returns in future.

Disclaimer:

Silver trading involves considerable amount of risk.It is not suitable for everyone.Please judge your risk capacity before investing.