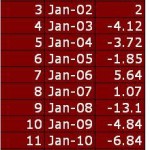

Gold prices sold off this week after pressured from couple of news like bullish dollor index,falling crude oil prices and no signal of next round of quantitative easing.

Federal reserve keep the interest rates at the record low level of 0.25% and signals the same for some period ahead. Analysts were expecting new stimulus package but fed not signalled anything about new rounds of quantitative easing after completion of QE2.Also fed has expectations of constant inflation rate ahead which have pressured silver prices.

A break in crude oil prices after EIA and united states signalled release of crude oil from strategic reserve programme,also weighed on Gold prices.

Some of the participiants are still bullish over Gold and looking as a good opportunity to enter in a gold market at lower levels.Long term target of $3000(Apprx.Rs.44,000 per 10 Grams) for Gold and $80 (Rs1,20,000 per kilo) for silver remain intact.

Gold prices ened at $1503 level in this week.Technically $ 1480 is a suppoert for short term and $ 1430 may prove long term support for gold.While $1520 may be a good selling opportunity in coming week.